***Updated: June 22nd, 2021***

Back when iGaming websites first launched in the late 1990s, numerous types of credit cards were immediately accepted because every wallet in the United States has at least one. Not to mention, they’re familiar, relatively secure, and people of all ages knew exactly how to use them.

As far as they were concerned, plastic was great since companies guaranteed transactions, confirming immediate settlement upon approval. Plus, no need to worry about collecting debts and looking like bad guys to members, making the situation a solid “double win”.

Presently only a few trusted operators take Mastercard, with the short list of top destinations below. These rankings are updated often as continuous research is conducted to ensure each is safe and maintain pristine reputations.

Those seeking additional specifics should select an above logo to peruse corresponding reviews documenting crucial facts and features. Anyone interested in learning particulars of bonuses can simply click Visit Now

to read details and explore offerings.

Mastercard Casinos

Credit options are embraced at all USA online casinos so Mastercard holders are never without somewhere to play. Surprisingly, this brand is usually more welcome than rival VISA since they act as a cooperative for over 25,000 international subsidiaries worldwide.

This was significant when the Unlawful Internet Gambling Enforcement Act of 2006 (UIGEA) tried to regulate activity by making it illegal for financial institutions to process monetary transactions between patrons and iGaming entities. Therefore, through the MC global network, chances were better that a foreign bank was ready and willing to accommodate. Of course, this became moot when SCOTUS struck legislation down in 2018 and legalized the entire industry.

This was significant when the Unlawful Internet Gambling Enforcement Act of 2006 (UIGEA) tried to regulate activity by making it illegal for financial institutions to process monetary transactions between patrons and iGaming entities. Therefore, through the MC global network, chances were better that a foreign bank was ready and willing to accommodate. Of course, this became moot when SCOTUS struck legislation down in 2018 and legalized the entire industry.

Regarding what occurs behind the scenes, all virtual plastic purchases obviously necessitate revealing personal details, which can sometimes be dangerous in a digital era. Operators do keep information on file, although utilizing equivalent encryption technology as banks, so everything is always easy and 100% safe going forward. Another fact to remember is most places impose minimum and maximum limits aside from any existing thresholds established by companies themselves.

Once approved, it’s instantaneous and credit checks aren’t performed if data used to create the profile matches what Mastercard has on file. They have thousands of employees across the world working on improving fraud protection, reduced liability, and identity theft, so it’s not uncommon for transfers to get falsely flagged if appearing irregular. However, acceptance rates are actually slightly higher than VISA deposits at betting websites via their robust global networks and excellent international partnerships. Consequently, reach for this first whenever possible.

Gamble Online with Mastercard

In this day and age, countless ways exist to move funds around but credit cards are still preferable for those valuing familiarity and clear paper trails of records. These individuals should strive to deposit at online casinos and sportsbooks with Mastercard instead of competitors due to success percentage and lower merchant fees.

This is important nowadays as tariffs are routinely passed directly on to customers, yet for many years they had no problem covering processing costs considering it was how 95% of clientele funded accounts. Sadly, the free ride is over for this banking method and if continuing to use it, be prepared to pay for the privilege, occasionally up to 8% or more.

An easier and cheaper alternative is found in this guide to Bitcoin gambling for U.S. players explaining precisely why it’s superior. Primarily, undertakings are completely confidential, experts unanimously agreeing it’s the future of finance.

Company History

The country’s love affair with plastic money began shortly after World War II when they were still referred to as charge cards

. John Biggins at Flatbush National in Brooklyn, New York saw millions of returning servicemen and women, and correctly predicted a lot of consumption would transpire in the Empire State (and beyond).

Biggins then devised Charg-It to facilitate buying goods without cash, allowing clients to immediately bring products home. Invoices were passed on to Flatbush National for reimbursement who were responsible for collecting the “loan” within 30 days. It was a brilliant scheme requiring Charg-It bearers to open accounts and exclusively shop at participating local merchants.

In the mid 1960s, Bank of America figured out a way to liberate shoppers from regional restrictions through an innovative network of partners across the nation that would guarantee purchases. BankAmericard, ultimately known as VISA, triggered The Buy Now, Pay Later Revolution

by eliminating obligations of full remittance within 30 days in favor of revolving credit and interest on “loans”.

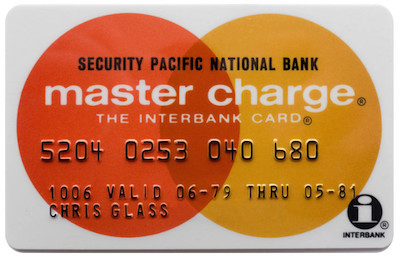

It didn’t take long to realize the groundbreaking system’s revenue potential and companies clambered for a piece of the action. In New York, First National City (eventually called Citibank) hustled its Everything Card onto the market. Out on the west coast a posse of heavy hitters including Wells Fargo, Bank of California, and Crocker joined forces to issue Master Charge: The Interbank Card.

After a decade of shuffling, merging, and positioning, the 1980s arrived with two major titans towering over the industry. The battle for supremacy had begun.