Many across the country have questions about U.S. online casino deposit methods and how winnings will be sent back. This is a result of confusion surrounding the current iGaming landscape and laws that seem to change every day, with unique legislation in each state. For years the easiest way to top up balances was with credit cards such as VISA or MasterCard, which always results in one particular question, “What is a CCVF and why do I need to send it?” Although it might feel a bit like a “scam” at the time, it most definitely isn’t, it’s just part of standard procedure.

First of all, “CCVF” stands for Credit Card Verification Form and it’s the paper work required by operators before authorizing an initial payout if a card was originally used to fund the account. This has been a normal industry stipulation for over two decades so don’t feel insulted if documentation is requested – it’s for the benefit of everybody involved.

Most websites include exact banking instructions in their Help Section but sometimes they’re buried deep in a hard-to-find page. If it’s a reputable destination it will clearly state what’s needed in the FAQ and any customer service representative will be able to relay all important information.

Why is a CCVF Necessary at an Online Casino?

The credit card verification form is necessary to validate instruments used to deposit, or to proactively register ones for the future. It can be demanded at any time to confirm a user’s identity or to ensure the person making transactions is indeed the legal owner. This is done in order to protect players and their money, not to mention operators themselves since they have a responsibility to 3rd party financial processors to ensure high standards are being followed.

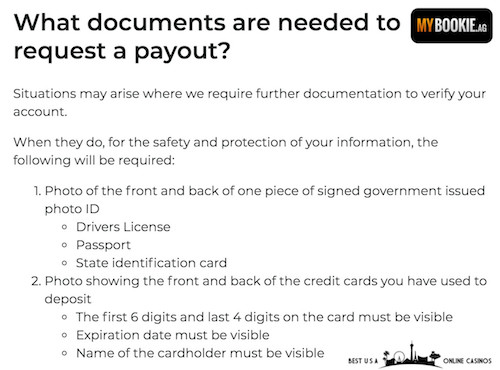

Normally, members must send a copy of the signed form along with photocopies of the front and back of cards, as well as a photocopy of the front and back of their driver’s license or another piece of government-issued ID such as passport or state identification. Sometimes they’ll want to see a utility bill or equivalent with a mailing address but this is asked for on a case by case basis.

Normally, members must send a copy of the signed form along with photocopies of the front and back of cards, as well as a photocopy of the front and back of their driver’s license or another piece of government-issued ID such as passport or state identification. Sometimes they’ll want to see a utility bill or equivalent with a mailing address but this is asked for on a case by case basis.

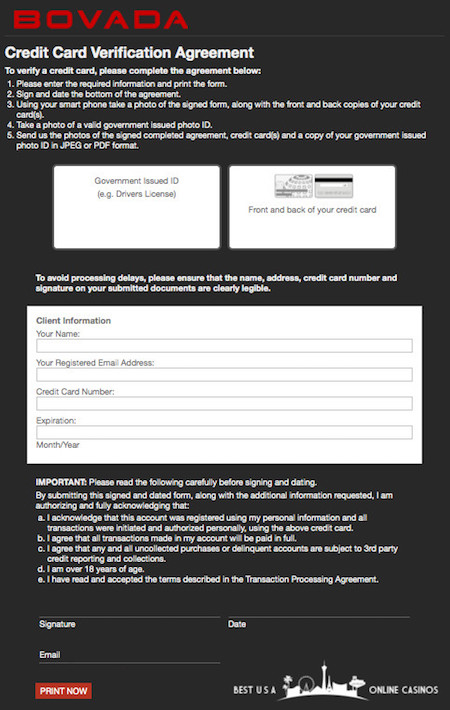

A clear example of what could transpire is experienced if depositing with credit card at Bovada since their Terms and Conditions state, As per the Processing Agreement, you may be required to submit a Credit Card Verification Form for each one used prior to receiving any withdrawals.

Therefore, players essentially agree to send a CCVF and proof of identity before even making a bet.

How to Fill Out a Credit Card Verification Form

When verifying a credit card the steps will always be the same whether a VISA, MasterCard, or American Express used. Required information will vary slightly depending on the operator but will usually be some variation of the following:

- Personal details such as name and address.

- Full account number, expiration date, and CVV number.

- A signature and date at the bottom of the form.

- A photo of the completed document.

- Copies of the front and back of the credit card(s).

- A copy of a valid piece of government-issued photo ID.

Once completed, everything is then sent to the website’s Finance Team via email attachments. Common mistakes include sending in blurry images, photos that are cut off, copies of the wrong plastic, or expired identification. Consequently, it’s prudent to double check everything is correct and legible before sending to ensure transactions are approved without delay.

Everything above could potentially be scanned and emailed if the smart phone camera is broken; just make sure the images aren’t too dark and agents can verify details. Most places specify accepted formats, with JPEG or PDF being most popular. Regardless of file type, CCVFs will probably need to be printed and signed because an e-signature option is rarely given.

Casino Payout Timeframes with Credit Cards Deposits

Payout timeframes are always changing and depend on many factors such as the specific betting site in question and whether or not they’re a recommended operator. Therefore, when a credit card is used to deposit at an online casino, it’s impossible to say with certainty how long it will take to get paid. Best ones typically approve submitted documents within 2 business days and put them into a queue to be processed in order received, so it all depends on how many there are at the time.

For example, it normally takes at least a month to receive winnings after Super Bowl because so many people are requesting withdrawals at the same time. The simple fact is actual human beings must approve each so it’s going to take time to get through the backlog.

For example, it normally takes at least a month to receive winnings after Super Bowl because so many people are requesting withdrawals at the same time. The simple fact is actual human beings must approve each so it’s going to take time to get through the backlog.

Of course, the other thing to keep in mind is it’s not possible to put a balance back onto VISA or MasterCard like operators in Europe and South America can do. Therefore, the only way to issue payouts is via check by mail, which can take up to a month to reach mailboxs. Yes, it’s frustrating to wait that long but it’s just the current environment.

This is why so many players have decided to fund gambling accounts at USA internet casinos with Bitcoin or other cryptocurrencies since winnings are sent back the exact same way, resulting in money being received in 48 hours instead of 4 to 6 weeks. Alt coins are simply a better mousetrap

providing speed, privacy, and security, so anyone making the switch will assuredly never go back to plastic.